File an S-Corp Election for Your Trucking Business

Whether you're forming a new business or changing your tax structure, we make it easy to file for S-Corp status — built specifically for trucking companies like yours.

What Is an S-Corporation?

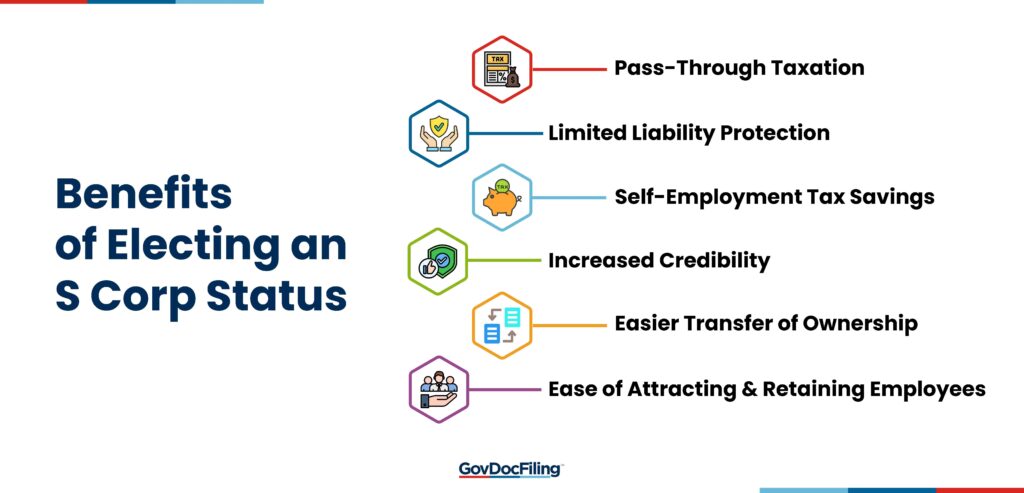

An S-Corporation is a tax status you can elect for your LLC or Corporation (Inc.) with the IRS. It lets your business avoid double taxation and can help owners save on self-employment taxes.

This is not a new type of business entity — it's a way your existing LLC or Corporation is taxed.

Why Trucking Companies Choose S-Corp Status

- Save on self-employment taxes by paying yourself a salary

- Avoid double taxation that comes with C-Corporations

- Still enjoy liability protection of an LLC or Corporation

- Be audit-ready and more attractive to lenders and investors

- Simplify tax reporting as your company grows

Built for Trucking Entities

We work with all trucking business structures:

- • C-Corporations electing to become S-Corps

- • LLCs switching to S-Corp status for tax savings

- • New businesses forming an LLC or Corporation and electing S-Corp from day one

Our S-Corp Filing Service Includes:

- IRS Form 2553 preparation and filing

- IRS Form 8832 (if required)

- Coordination with your state filings

What We Need to Get Started:

We collect different info depending on whether you're forming a new entity or updating an existing business.

If you're forming a new LLC or Corporation:

- Desired business name

- Business owner’s name and contact

- State of formation

- Business purpose

- EIN (we can help obtain it)

If you're electing S-Corp for an existing LLC or Corporation:

- Legal business name

- EIN

- State of registration

- Date business was formed

- Ownership details

- Preferred tax year

- Owner’s valid ID

Common Trucking Scenarios

- Switching from sole proprietorship to LLC or Corp with S-Corp election

- Already an Inc. and now want to reduce taxes via S-Corp

- Running a dispatch or factoring arm under your main trucking business

- Planning to pay yourself a salary and save on taxes